Adding custom fields to WooCommerce invoices might seem like a lot of customization and editing work. But, WebToffee’s PDF Invoice and Packing Slip plugin for WooCommerce makes the process a whole lot easier.

Let’s take a look at the steps for adding custom fields to WooCommerce invoices.

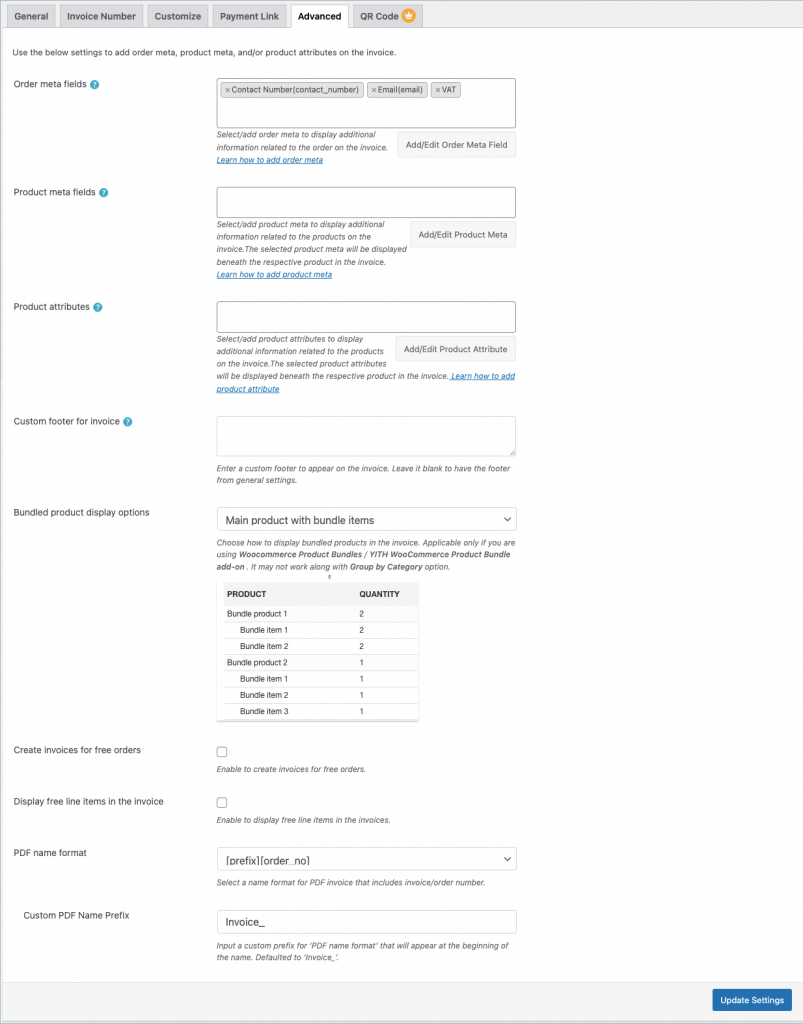

From the invoice settings window, move on to the Advanced tab. You can add:

The plugin allows adding additional order information like Delivery date, Payment date, Place of supply, VAT, GSTIN, ABN, etc., or any other company tax ID as order meta in the invoice. You can add order meta in two ways:

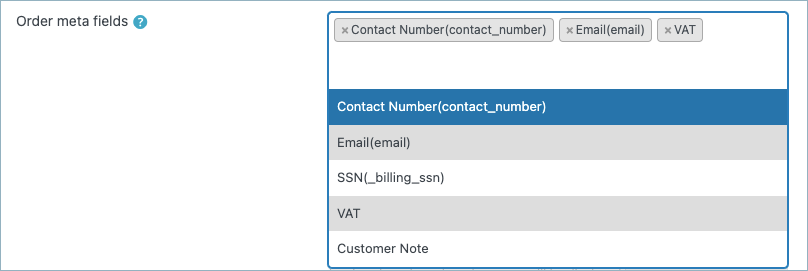

Method 1: Select a required item from the Order meta field drop-down. The list of default order metadata populated in the drop-down are as shown below:

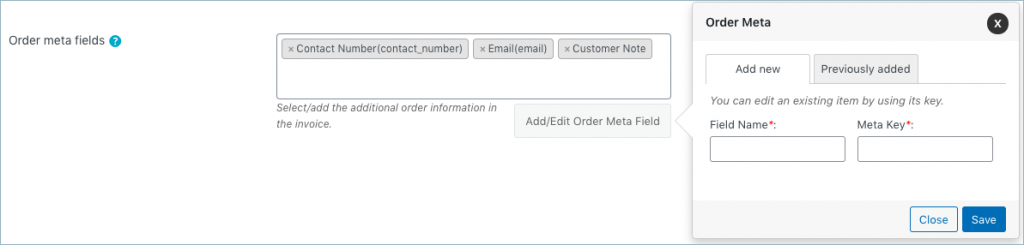

Method 2: To add other custom order meta details (probably from another third-party plugin) other than the ones displayed in the drop-down,

Note: The order meta key, if configured, can be found in the custom field section of WooCommerce Order page.

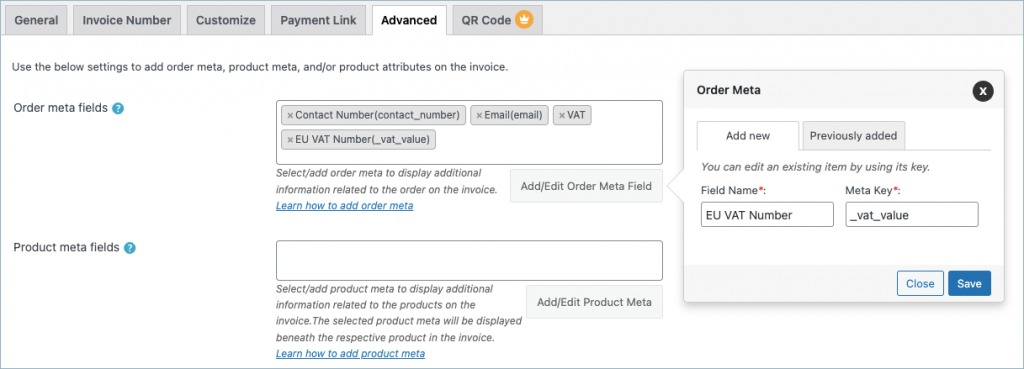

For example, to add a custom VAT number in the invoice populated from the plugin EU VAT Number for WooCommerce, you will have to key in an appropriate field name and its corresponding meta key in the checkout meta key fetcher pop up as shown below:

Get the meta key for the VAT Number (_vat_value) from the respective plugin’s documentation.

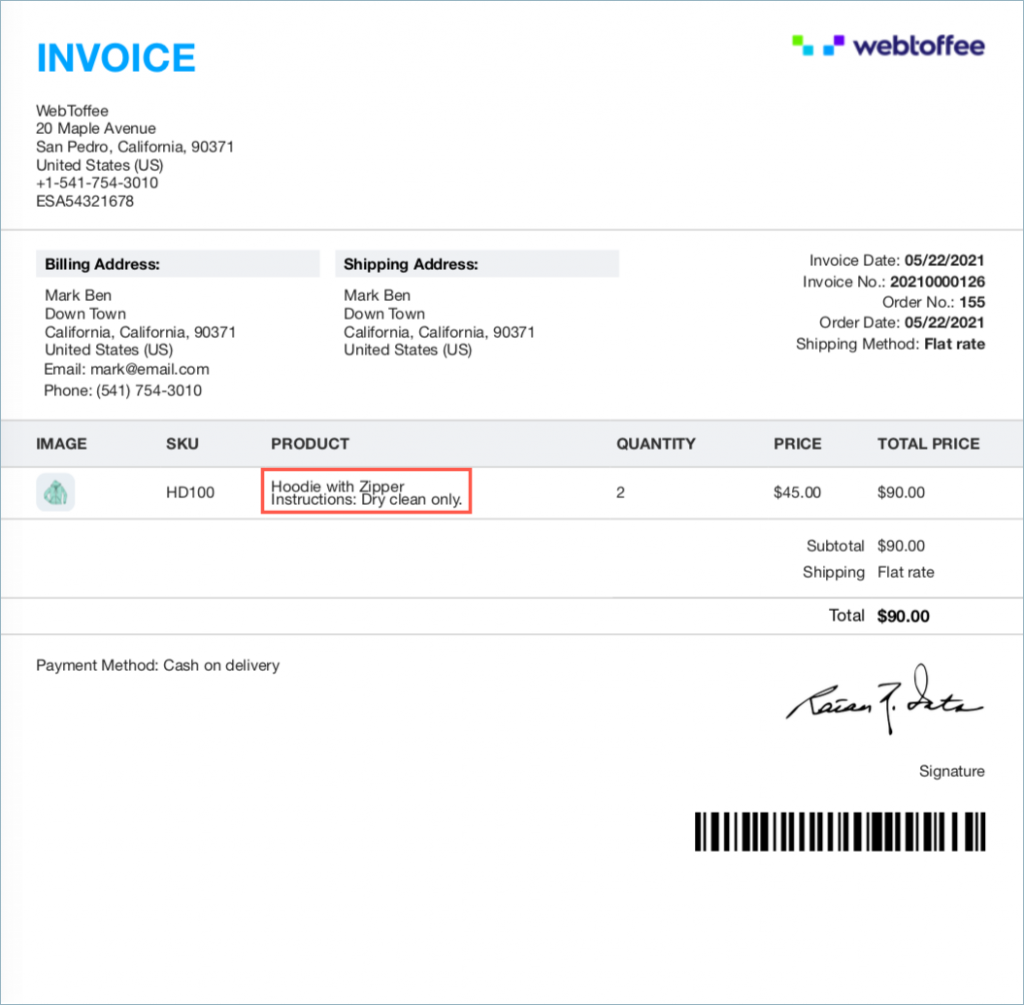

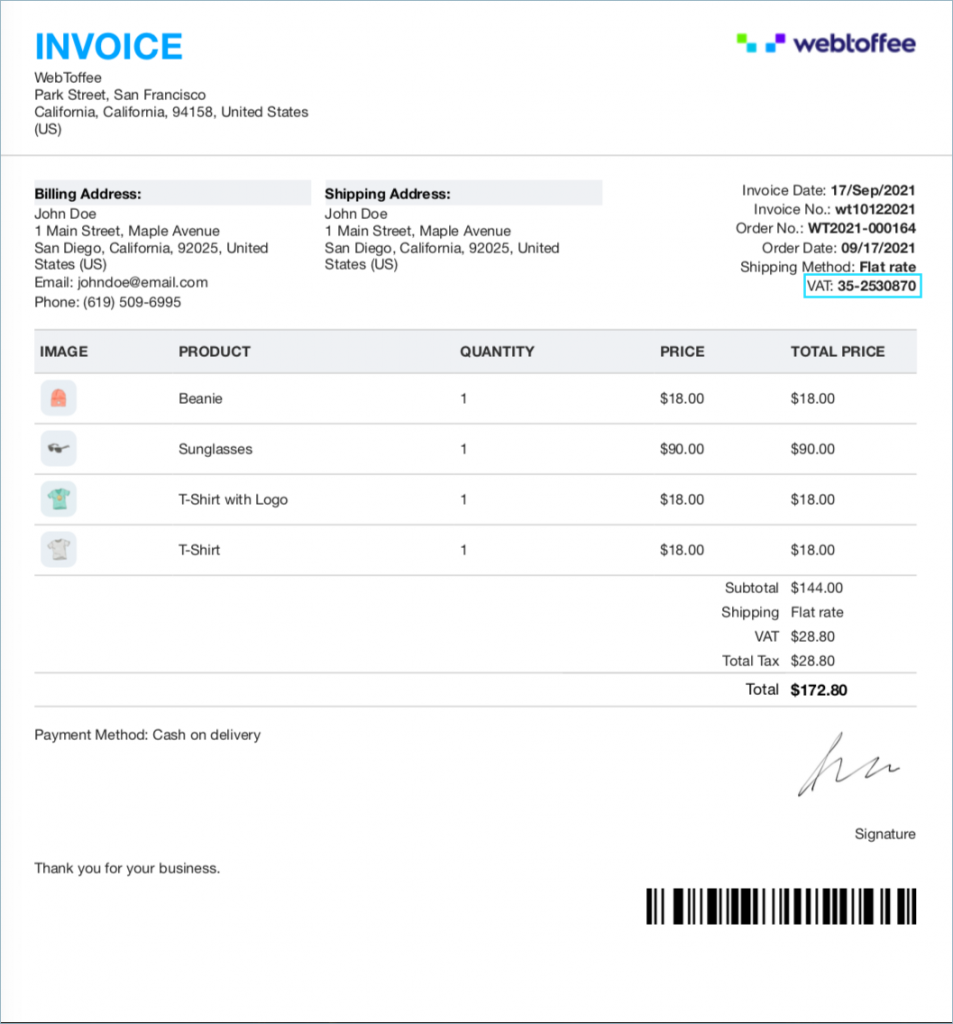

The invoice with its order meta EU VAT Number will be as shown below:

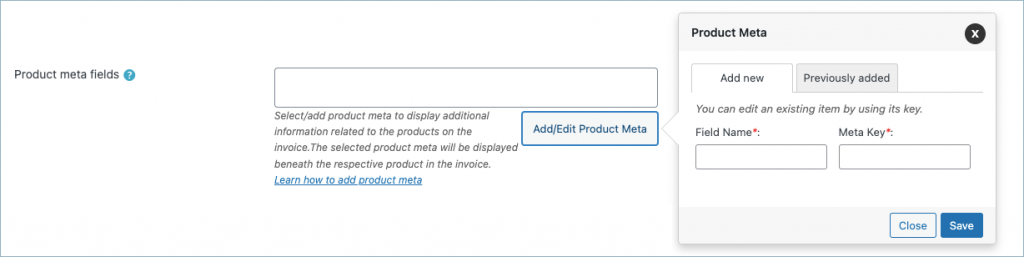

From Product meta fields,

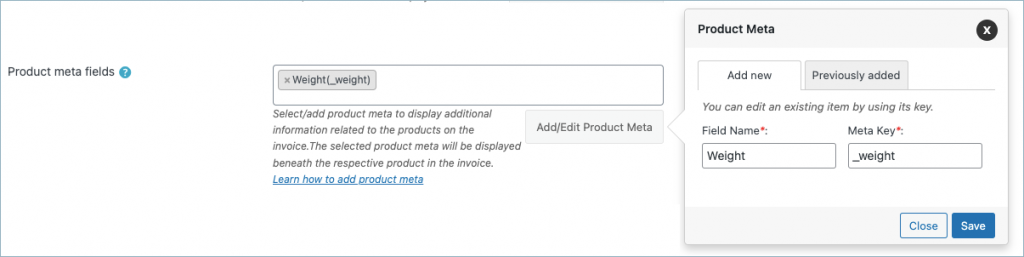

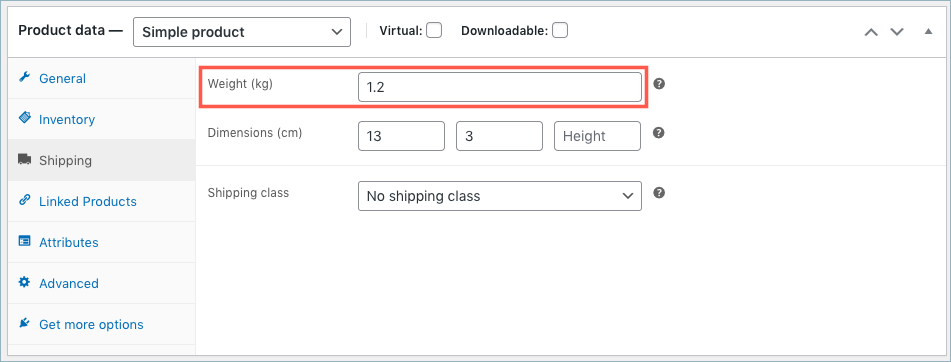

For example, the WooCommerce product meta for weight is ‘_weight’. Let us see how we can display it in our invoice.

Insert the field name and meta key in the following manner:

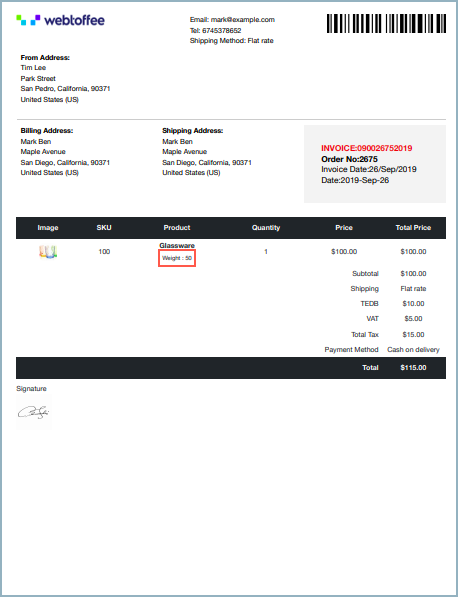

A sample invoice with a product metadata Weight will be as shown below:

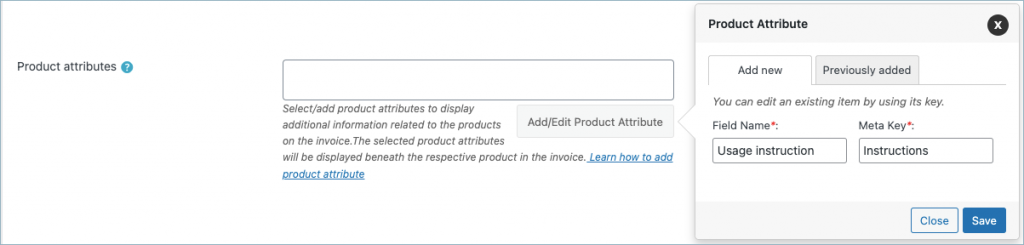

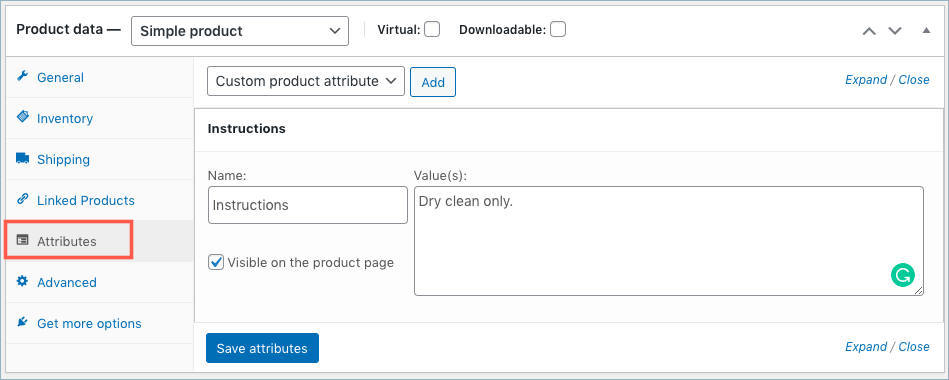

For example, let’s create a custom product attribute for a product. Go to Products from your WordPress dashboard. From the product data panel, move on to the Attributes section.

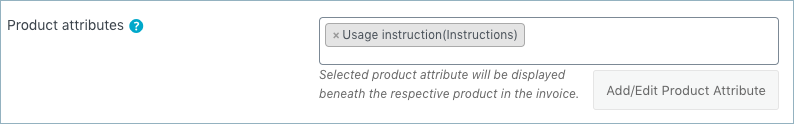

The string entered for the field ‘Name‘ must be added as the Meta Key in the invoice settings. Upon adding the attribute, the screen will be as shown below:

A sample invoice with product attribute will be as shown below: