Nepal’s digital innovation ecosystem is at a nascent stage; however, it is one of the fastest-growing industries. ICT service exports were worth over NPR 1.9 billion in FY 2021/22 compared to just over NPR 540 million in FY 2019/20 and NPR 760 million in FY 2020/21. Recent years have seen a rise in the number of IT-enabled businesses, thanks to a developing ecosystem of digital entrepreneurship. A new generation of domestic IT service providers has emerged who offer innovative and specialized solutions to multiple local demands.

Nepal’s emerging startups have developed digital products that have eased the lives of Nepalis over the past decades – through accessible education, ride-sharing platforms, automated HR systems, health systems, financial apps, food services, logistics and support services, among others. Homegrown e-commerce, digital services, logistics, payment platforms, and mobile wallets have turned out to become huge success stories in Nepal’s tech space. However, despite the growing ICT sector, local IT firms are perpetually faced with a range of complex issues that impact effective operations and growth opportunities for the sector.

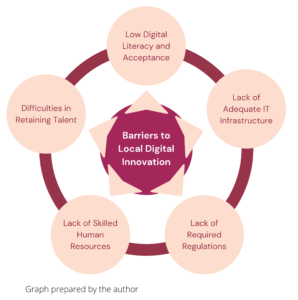

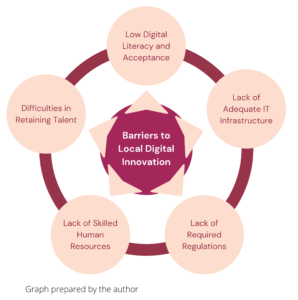

Some of the key barriers to innovation are highlighted below:

Figure 1: Barriers to Local Digital Innovation in Nepal

Due to unclear or outdated legislation, innovative tech startups struggle to comply with the law. When IT companies try to register their company with the government, they frequently discover that there is no specific category that accommodates them. The Nepal Standard Industry Classification (NSIC) categorizes most IT-related firms into “programming”, “computer consulting”, “web portals” and other “IT and computer service activities”. None of the laws in Nepal clearly define startup, which creates further ambiguity. Entrepreneurs are frequently discouraged from taking chances and implementing innovative ideas due to a lack of supportive policies for tech-based companies. The Government of Nepal drafted an e-commerce bill almost two years ago, however, progress on the bill is unknown.

Similarly, the outdated transportation law in Nepal, which virtually forbids private automobiles from for-profit activities, makes it difficult for ride-sharing startups to function. For instance, ride-sharing businesses like Pathao and Tootle fall under the present regulatory framework’s definition of an online store or website, and they have been facing challenges in complying with the rules. Furthermore, the government has not yet defined its regulatory and policy stances on cutting-edge technology like artificial intelligence (AI) and the internet of things (IoT). This type of delay will inevitably hinder the innovation and growth of tech firms.

While lawmakers have vowed to create new regulations to encourage technology in the various economic sectors, there has been little to no movement as of today. The government must acquire the political will, knowledge, and motivation needed to reform regulations in a way that would encourage private sector development in the digital industry. Furthermore, the government should prioritize interventions for e-commerce and other ICT products as soon as possible in terms of regulatory requirements while also formulating regulations to encourage greater Investment in the regional IT sector.

For startups in Nepal, expanding is near impossible owing to a shortage of qualified technical and mid-level managers. Similarly, retaining talent is one of the toughest challenges. Due to the subpar quality of professional training and tech education, many businesses end up spending months investing in new-hire training. Only around 7,500 students take up IT-related courses each year and every year, around 5,500 graduate from IT colleges in Nepal. Out of this, merely 20% join the IT industry in Nepal while the rest either move abroad or choose different career paths. Even out of the 20% who remain in the industry, only a limited number of technicians are willing to start new ventures or join local tech firms. The high rate of migration of skilled employees also reduces the availability of qualified managers and technicians. Since few graduates stay in the workforce long enough to advance to middle management, businesses must actively invest in attracting and training graduates. This has proven to be one of the biggest challenges for Nepali tech firms.

Therefore, it is extremely important to enhance skill-building programs. The private sector and the government need to work together to update the IT curriculum to better reflect industry demands. Similarly, the expansion of more business incubators and boot camps could also help IT companies and resources become more capable. The gap in the top level can also be fulfilled if the government permits the hiring of talented foreigners in Nepali businesses.

Local Nepali IT companies providing products and services to the domestic market find it extremely difficult to retain good employees. While migration is one of the reasons companies have a hard time retaining talent, the growing Business Process Outsourcing (BPO) industry in Nepal is another major reason that has put the majority of Nepali tech companies in an existential crisis. In essence, market forces discourage tech professionals from offering services for costs that are lower than what they receive for outsourcing jobs. The prices that BPOs are willing to pay for recruiting are higher than what the local tech market in Nepal can bear. This wage-rate gap has created every disincentive for Nepali tech expertise to service local clientele, resulting in local service-providing IT firms either not getting the required resources or having resources leave to join BPOs. Therefore, those who do not outsource are at risk of vanishing from existence.

Skilled resources cannot be stopped from leaving for better-paying opportunities. However, to retain such employees, local companies can create an attractive work culture that creates opportunities for employees to grow and develop. Similarly, with an increasing number of Private Equity and Venture Capital firms, along with the inflow of funding from development agencies, opportunities for local IT companies to access capital would also increase. This would help the companies pay good money for their resources.

The weak IT infrastructure and absence of high-calibre IT parks in Nepal have also had an impact on the growth of Nepal’s IT industry. The only region with adequate infrastructure is Kathmandu valley, where the majority of IT companies are located. Second, the demand for household IT services is constrained by the low broadband penetration rate and the subpar quality and price of mobile internet. Specialized technology parks may assist constrained areas to acquire sufficient technological and infrastructure capacity. However, the lone government-run IT Park in Nepal has had difficulty drawing business mostly because of the inadequate infrastructure. The government can overcome the problem of having inadequate IT infrastructure, and Improve and modernize the current IT Park with more private sector involvement.

While the use of digital payment systems has skyrocketed in recent years, the use of such channels for payment of goods bought online is still limited and cash continues to be the preferred method of payment for Nepali online buyers. Similarly, the digital divide between the urban and rural populations is a significant challenge for expanding the acceptance of digital products and services. Local tech companies, therefore, face challenges while expanding as they are compelled to invest in digital awareness as well, aside from focusing on developing and marketing their products. Unless the acceptance of digital products and literacy does not increase in major parts of the country, local digital companies would have a hard time expanding their market.

Way Forward

Given that domestic IT providers have a strong capacity to influence the market, it is crucial to consider their potential. The digital economy in Nepal has been growing rapidly, but issues like inefficient market systems, a lack of human capital, a lack of relevant policies and the country’s widespread digital disconnectivity are hindering the development of local digital companies. It is necessary to focus on the expansion of digital infrastructure, digital literacy, and training opportunities outside the Kathmandu valley.

Sugam Nanda Bajracharya is an MBA graduate from Stamford International University. Currently, he is working as a Beed at Beed management and a Research Associate at Nepal Economic Forum. Sugam works actively with the private sector and development partners on topics related to trade, sectoral studies, economic policy research, policy and strategy development.